Investing in

the

future, today.

Levstrust

Spotlight

Learn more about what navigates our investment teams’ conclusion.

Fresh inception for fixed income.

We see a silver edge in the cloud that has hung over the bond market over the previous year: the cumulative interest rate goes up that drove record annual losses have simultaneously returned the asset class to greater purpose going forward. Going further, the elevated uncertainty and volatility in the current environment give room for the potential for active managers employing deep research to bring about outperformance.

Levstrust ESG Integration

Where Macro and Fundamental Analysis Converge:

Our Business

Asset Management

We invest across Yield, Hybrid, and Equity markets, searching to generate superfluity returns for our clients across the full risk-reward scope.

Yield

Our Yield profession spans the financing universe across general and private markets, providing innovative lending and capital solutions for magnification.

Hybrid

Our Hybrid profession provides companies with flexible equity and debt solutions at scale and invests in all market territory.

Equity

Our Equity profession is focused on value-oriented opportunities where we can drive financial and operational performance to build stronger firms.

Asset Management

We invest across Yield, Hybrid, and Equity markets, searching to generate superfluity returns for our clients across the full risk-reward scope.

Yield

Our Yield profession spans the financing universe across general and private markets, providing innovative lending and capital solutions for magnification.

Hybrid

Our Hybrid profession provides companies with flexible equity and debt solutions at scale and invests in all market territory.

Equity

Our Equity profession is focused on value-oriented opportunities where we can drive financial and operational performance to build stronger firms.

INVESTMENT PLATFORM

We are passionate, independent investors united by our commitment to research-driven investment solutions and client service. With 718 investment professionals based in 20 portfolio management centers, we offer clients around the world investment solutions across asset classes, capitalizations, styles and geographies in both public and private markets, as well as multi-asset class solutions that bring them all together. To serve this broad base of institutions, advisors and individuals, our strategies are available through a variety of investment vehicles.

Ultimately we are judged on our ability to deliver risk-adjusted returns to clients over time, and we stand by our record as a testament to the prowess of our investment professionals and the strength of our firm culture.

Our triumph is rooted in energy and stability, delivering tech-forward solutions and expanding our relationship to the financial services biosphere.

We’re a firm working with our clients and communities to solve problems that matter. And we’re on a mission to build brave futures through the power of connection.

What sets us apart

We deliver technology and investment solutions that connect the financial services industry.

With capabilities across investment processing, operations, and asset management, we work with corporations, financial institutions and professionals, and ultra-high-net-worth families to solve problems, manage change, and help protect assets.

Wealth management technology and operations

Global Investment Solutions

Finding the right investment opportunity is about creating solutions customized to the needs of your portfolio. Levtrust Financial Investment Solutions (GIS) segment helps investors meet their objectives through tailored portfolio construction and rigorous investment selection. Our business provides investors access to a range of opportunities across private equity. Our business offerings include primary, secondary and co-investments, commingled funds and separately managed accounts.

FINANCING GLOBAL GROWTH

Global Credit

Strong performance starts with strong partnerships. Once we invest in a company, we put our full resources behind it, leveraging our Credit platform, as well as the resources of the Levtrust network to accelerate business objectives. We provide creative solutions and scale to borrowers, resulting in differentiated opportunities for investors to capture value across the credit spectrum.

Leading with Trust

Trust is foundational to our growth and delivering exceptional outcomes. Our team of credit investment professionals has established long term, trusted relationships with hundreds of credit partners worldwide and we benefit from Levtrust long-standing sourcing relationships. We have access to approximately 1,000 lending relationships across the globe.

Advancing Solutions and Expanding Opportunities Through our Integrated Platform

Levtrust Financial Credit platform manages $10 billion in assets across the risk return spectrum: from liquid, to illiquid, to real asset strategies. Since 1999, our platform has leveraged Levtrust scale, network and industry expertise to offer borrowers creative, holistic capital structure solutions. We also work with investors to create value across a wide range of credit strategies.

Managing Risk through Rigorous Due Diligence

Our investors and borrowers see us as a trusted partner, helping drive business growth across market cycles. We have an ability to provide creative structures to borrowers while minimizing downside risk through our rigorous approach to due diligence and credit selection. We are highly selective in our approach and close on less than 5% of originations. We are equally focused on monitoring our credit risk across our portfolios, which has enabled us to minimize our default rate while maximizing long term returns.

Levtrust by the Numbers

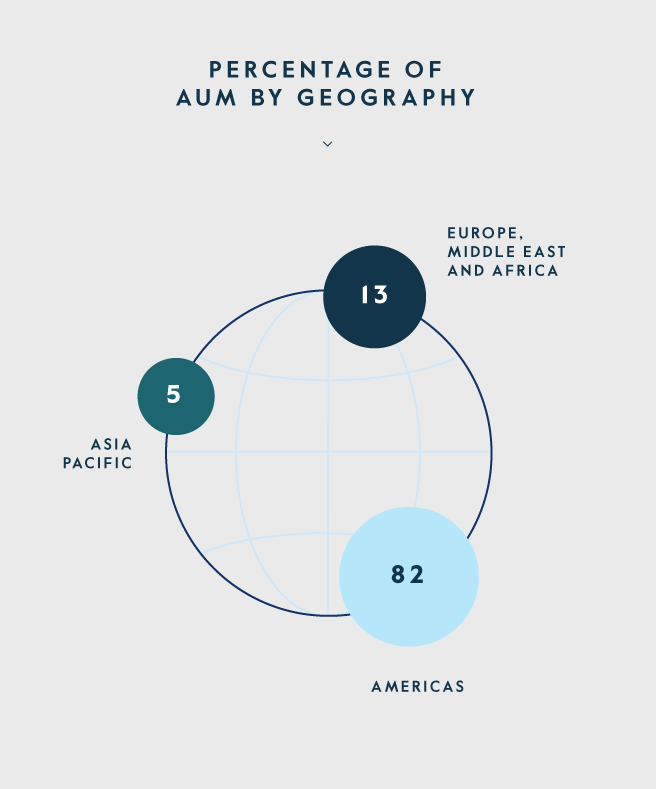

As one of the world’s largest investment management firms, our assets are diversified across our business segments as well as the industries, sectors and regions in which we invest.

GLOBAL PRIVATE EQUITY

Levstrust’s Global Private Equity business is one of the world’s largest and most diversified private equity platforms, spanning industries, geographies and strategies to deliver transformational results for our partners—management teams, portfolio companies, and fund investors. At Levstrust, we strive to build better businesses through our global platform, local insights, and deep industry expertise.

GLOBAL CREDIT

Strong performance starts with strong partnerships. Once we invest in a company, we put our full resources behind it, leveraging Levstrust’s Global Credit platform, as well as the resources of the Levstrust network to accelerate business objectives. We provide creative solutions and scale to borrowers, resulting in differentiated opportunities for investors to capture value across the credit spectrum.

Global Investment Solutions

Finding the right investment opportunity is about creating solutions customized to the needs of your portfolio. Levstrust’s Global Investment Solutions (GIS) segment helps investors meet their objectives through tailored portfolio construction and rigorous investment selection. Our business provides investors access to a range of opportunities across private equity. Our business offerings include primary, secondary and co-investments, commingled funds and separately managed account

Responsibility Throughout Levtrust

To implement our responsibility strategy and measure its progress, we’ve created a structure that reflects our firm-wide commitment to responsibility, from the Responsibility Steering Committee to ESG analysts and investors as well as the infrastructure that supports them.

Levstrust LLC is a leading global growth investor. The firm has more than $10 billion in assets under management. The firm’s active portfolio of more than 255 companies is highly diversified by stage, sector, and geography. Levstrust is an experienced partner to management teams seeking to build durable companies with sustainable value. Founded in 1999, which have invested more than $107 billion in over 1,000 companies in more than 40 countries. For more information please visit www.levtrust.com

Copyright © 2025 Levtrust. All Rights Reserved.